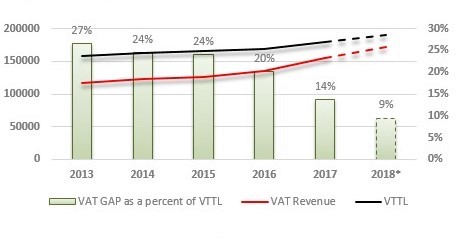

CASE REPORT: an 8 % increase in VAT revenue due to increased compliance, and a 6 % increase due to favourable economic climate - CASE - Center for Social and Economic Research

Finland: Technical Assistance Report-Revenue Administration Gap Analysis Program-The Value-Added Tax Gap : Finland:

Republic of Estonia : Republic of Estonia : Technical Assistance Report-Revenue Administration Gap Analysis Program-The Value-Added Tax Gap:

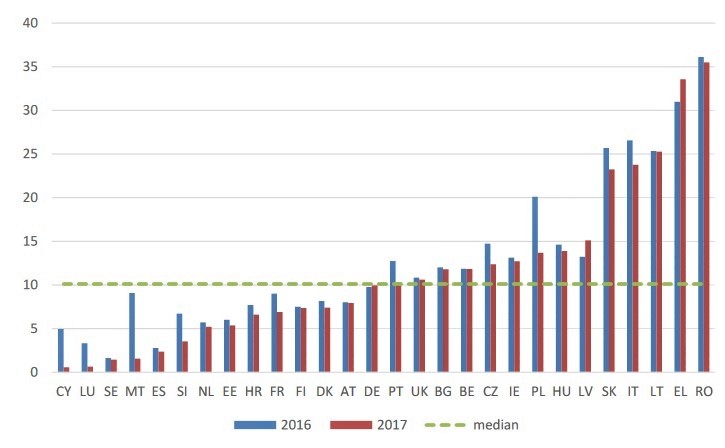

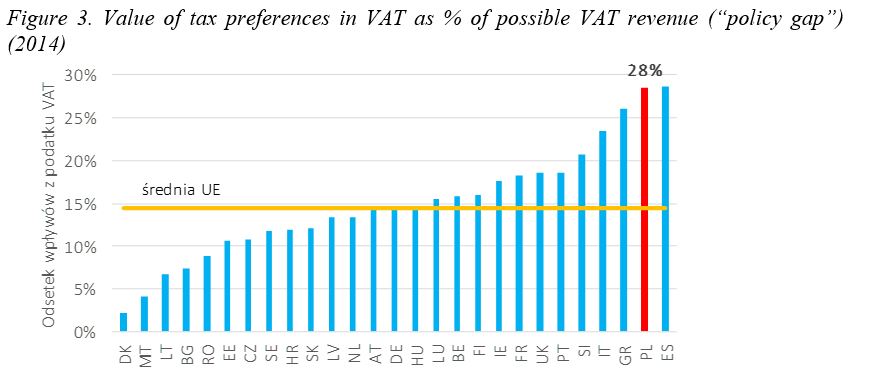

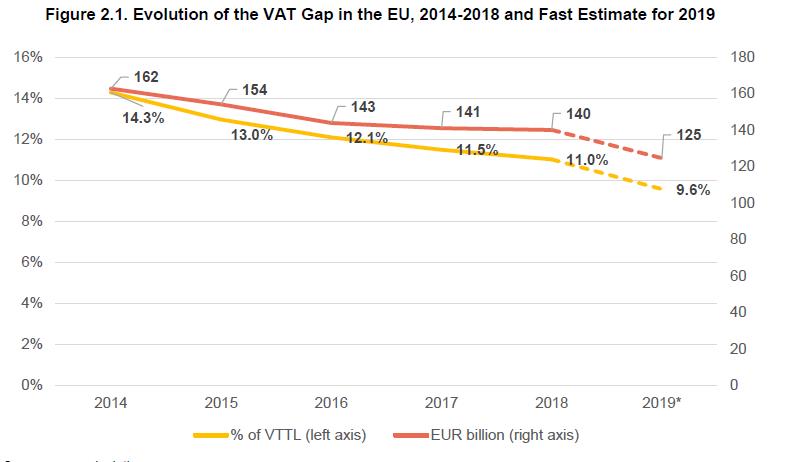

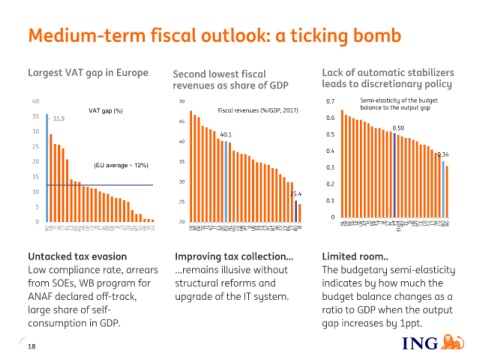

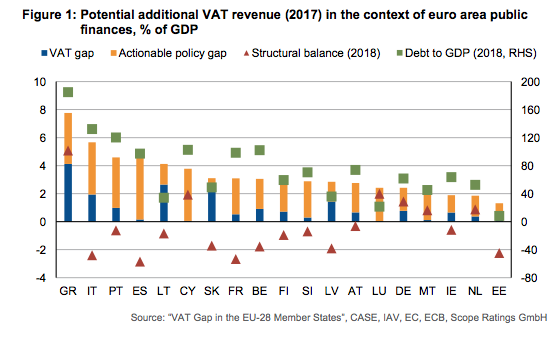

Mind the VAT gap: more effective consumption-tax collection could improve Eurozone's public finances

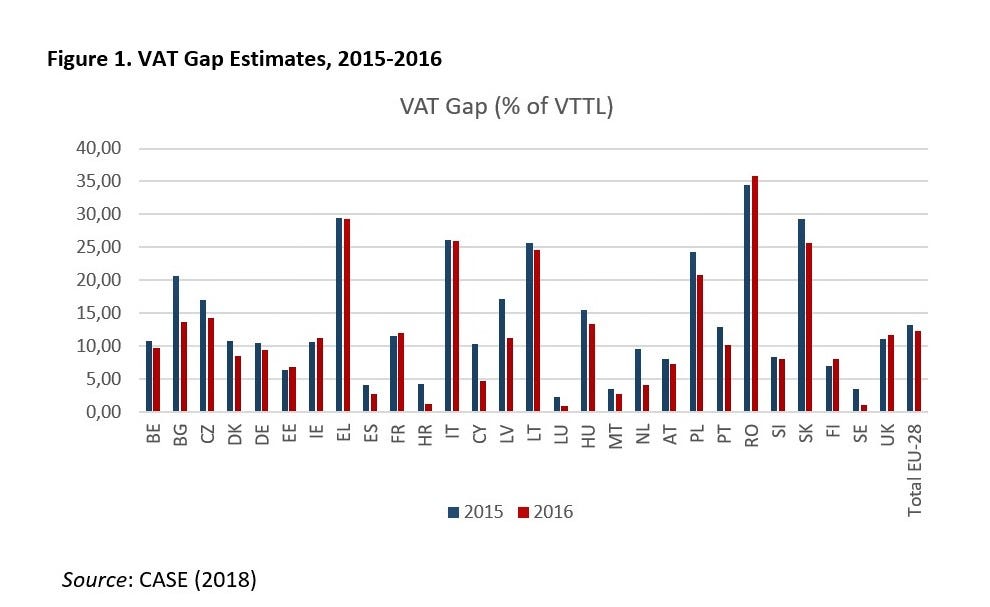

Non-compliance costs Europe €168 billion in VAT revenues in 2013 - CASE - Center for Social and Economic Research

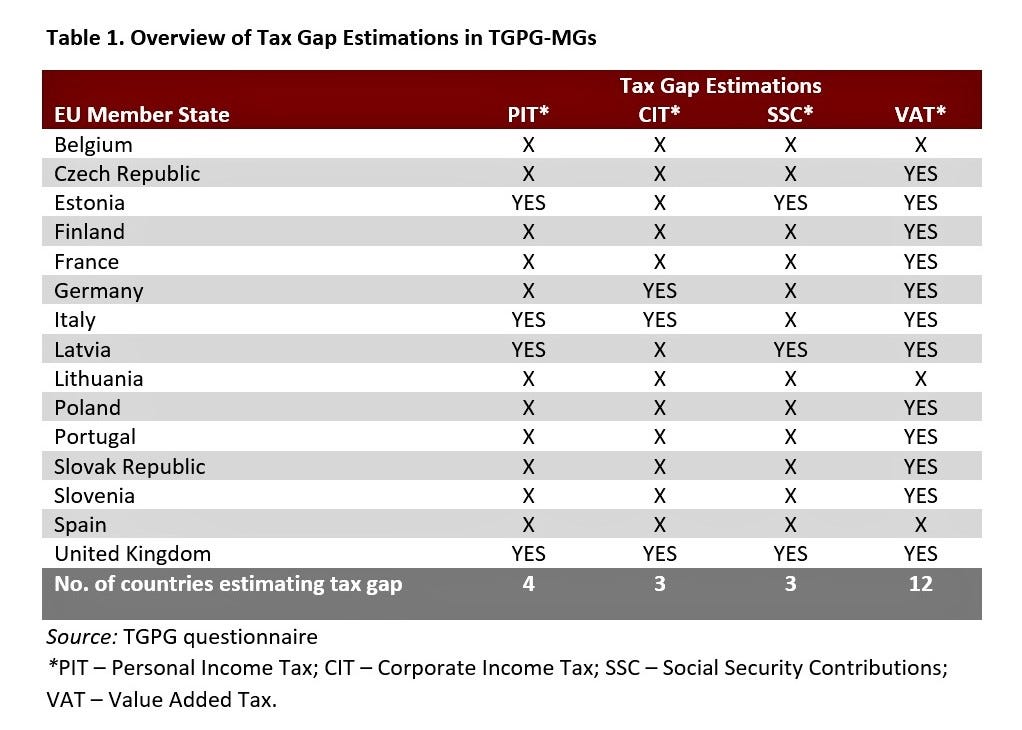

The Revenue Administration-Gap Analysis Program : The Revenue Administration-Gap Analysis Program : Model and Methodology for Value-Added Tax Gap Estimation: